In today's rapidly evolving financial landscape, the journey of intergenerational wealth transfer is a profound act of love and foresight that shapes families for generations.

It transcends simple monetary exchanges, embedding values, legacies, and family aspirations into the fabric of our financial decisions.

The Legacy Ladder provides a clear, step-by-step framework to navigate this complex process, ensuring that wealth flows smoothly and meaningfully to those who inherit it.

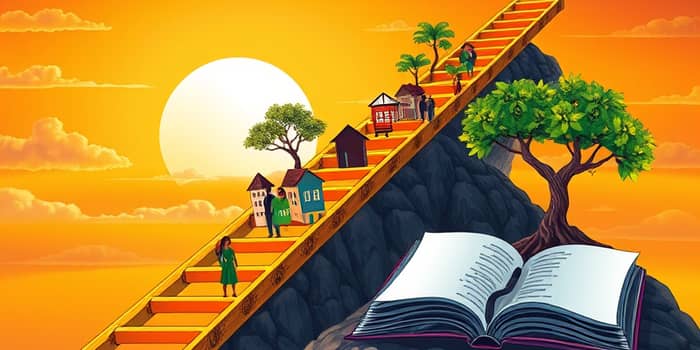

Imagine standing at the base of this ladder, looking up at rungs that represent increasing levels of planning and sophistication.

Each step upward offers greater control, protection, and alignment with your deepest family goals.

This isn't just about avoiding probate or minimizing taxes; it's about crafting a narrative that endures.

As we embark on this exploration, remember that building wealth for future inheritors is a journey of both heart and strategy.

Understanding the Legacy Ladder Framework

The Legacy Ladder is a metaphorical structure that outlines progressive stages in estate planning.

At its lowest rung, individuals do nothing, risking intestacy where state laws dictate asset distribution.

Moving up, basic tools like beneficiary designations on accounts offer some protection.

Higher rungs incorporate wills, trusts, and comprehensive plans that integrate all aspects of wealth management.

This framework emphasizes that wealth transfer is not a one-size-fits-all process but a customizable path.

By climbing this ladder, families can achieve greater financial stability and peace of mind.

The Great Wealth Transfer: A Historical Shift

We are witnessing an unprecedented event known as the Great Wealth Transfer, where trillions of dollars are moving between generations.

Baby boomers and the Silent Generation are poised to bequeath over $84 trillion in assets by 2045.

This monumental shift holds broader implications for the economy, influencing everything from real estate markets to philanthropy.

For beneficiaries, it presents opportunities for socioeconomic mobility and investment in new ventures.

Understanding this context is crucial for anyone involved in wealth planning today.

Motivations for Transferring Wealth

Why do people dedicate so much effort to passing down assets? The reasons are deeply personal and multifaceted.

- Legacy preservation: Ensuring the family name continues with pride and that accumulated wealth supports future generations.

- Financial foundation: Providing children and grandchildren with resources for education, homeownership, or starting businesses.

- Life-changing support: Inheritances today can create multi-generational wealth if managed wisely, offering a safety net in uncertain times.

These motivations highlight that wealth transfer is about more than money; it's about empowering loved ones to thrive.

Methods and Tools for Effective Wealth Transfer

A variety of mechanisms exist to facilitate smooth wealth transitions, each with unique advantages.

Primary methods include inheritance, gifting, trusts, and life insurance, which can be tailored to individual needs.

Estate planning tools are essential for implementing these methods effectively.

- Trusts: Allow control over asset distribution, avoid probate, and provide tax efficiency and asset protection.

- Wills: Clearly outline wishes to prevent disputes and ensure personal directives are followed.

- Beneficiary designations: Simple tools on accounts that help bypass probate, such as Transfer on Death instructions.

- Family Limited Partnerships (FLPs): Enable families to pool assets like businesses, maintain decision-making power, and reduce estate taxes.

To illustrate the progression on the Legacy Ladder, consider this comparison of key steps:

Choosing the right tools depends on factors like asset types, family dynamics, and long-term goals.

Tax Strategies to Preserve Wealth

Minimizing tax liabilities is a critical aspect of wealth preservation that can significantly impact what heirs receive.

Effective strategies include annual gifting, which uses the gift tax exclusion to transfer wealth gradually.

As of 2024, this allows up to $18,000 per recipient per year without triggering taxes.

- Irrevocable trusts: Shield assets from estate taxes and provide control over inheritance timing and conditions.

- Charitable giving: Incorporating philanthropy into estate plans reduces tax burdens and aligns with personal values.

- Estate tax reduction: Careful planning with tools like FLPs can lower the taxable value of estates, preserving more for heirs.

Working with tax professionals ensures these strategies are implemented correctly and legally.

Generational Considerations and Challenges

Modern families face unique complexities that require thoughtful adaptation in wealth transfer plans.

As lifespans increase, wealth may skip generations, going directly to grandchildren for needs like education.

Changing family structures, such as blended families or single-parent households, add layers of difficulty to inheritance decisions.

Generational values shifts are also evident, with younger heirs often prioritizing sustainable and impact investments.

- Skipping generations: Direct transfers to grandchildren can address immediate financial needs like university fees.

- Diverse family arrangements: Nontraditional setups necessitate clear documentation and legal frameworks to avoid conflicts.

- Values alignment: Millennials and Gen X may favor investments that reflect social or environmental concerns, requiring updated strategies.

Addressing these challenges proactively can prevent misunderstandings and ensure harmony.

Opportunities for Beneficiaries

Receiving an inheritance opens doors to numerous possibilities that extend beyond personal gain.

Beneficiaries can achieve financial stability through assets like cash, real estate, or businesses.

This newfound wealth offers chances for investment, entrepreneurship, and contributing to community growth.

- Investment opportunities: Using inherited funds to diversify portfolios or explore new markets.

- Socioeconomic mobility: Climbing the economic ladder through education, homeownership, or business ventures.

- Real estate impact: Investing in property or liquidating assets to influence local housing markets positively.

- Entrepreneurship: Funding startups or innovative projects that drive economic growth and job creation.

- Philanthropic endeavors: Supporting causes that reflect family values and make a lasting social impact.

Embracing these opportunities requires education and responsible stewardship.

Best Practices for Successful Wealth Transfer

For wealth holders, or "givers," adopting a proactive approach is key to a smooth transition.

- Start early: The earlier planning begins, the more options are available for customization and adjustment.

- Keep accurate records: Document all assets, including bank accounts, investments, and real estate, to avoid confusion.

- Communicate values: Discuss how wealth was built and the principles behind it, not just the monetary aspects.

- Educate heirs: Mentoring future stewards on financial management ensures they are prepared to handle inheritances wisely.

- Create a family mission statement: Outline shared goals and values to guide decisions across generations.

- Develop comprehensive estate plans: Include wills, trusts, healthcare directives, and tax-efficient strategies tailored to your situation.

For beneficiaries, or "receivers," taking an active role in the process is equally important.

- Educate themselves: Learn about financial management, investment basics, and the responsibilities that come with wealth.

- Honor family legacy: Understand the history and values behind the inheritance to carry them forward with respect.

- Work with trusted advisors: Consult financial planners, lawyers, and tax experts for guidance on managing received assets.

For both parties, collaboration and open dialogue are essential.

Critical Success Factors in Wealth Transfer

A successful transfer hinges on elements that go beyond financial metrics, focusing on emotional and relational aspects.

Clear financial goals must be established, such as funding education or preserving family homes.

Specificity in asset allocation helps determine what to keep, sell, or gift early.

- Stewardship and responsibility: Fostering a sense that heirs are custodians, not just recipients, of the family legacy.

- Multi-generational perspective: Planning with a long-term view that extends beyond immediate transfers to future descendants.

- Proactive communication: Engaging in honest conversations early to align expectations and reduce potential conflicts.

- Professional guidance: Leveraging experts to navigate complex legal and financial landscapes effectively.

Ultimately, wealth transfer is about building a bridge between past achievements and future dreams.

By embracing the Legacy Ladder, families can climb toward a future where wealth serves as a tool for empowerment, connection, and lasting impact.

Let this be your invitation to start the conversation, take that first step, and craft a legacy that resonates through time.

References

- https://ttwealth.co.uk/what-is-intergenerational-wealth-transfer/

- https://en.wikipedia.org/wiki/Great_Wealth_Transfer

- https://www.kiplinger.com/article/retirement/t021-c032-s014-find-the-right-rung-on-the-legacy-planning-ladder.html

- https://legacyassuranceplan.com/articles/beneficiary/great-wealth-transfer-estate-tax-changes

- https://www.apw-ifa.co.uk/passing-on-wealth-without-losing-control/

- https://www.carterwealth.com/insights/passing-on-your-wealth-strategies-for-intergenerational-wealth-transfer/

- https://ghcf.org/articles/great-wealth-transfer/

- https://www.rbcwealthmanagement.com/en-us/insights/a-new-era-of-wealth-transfer-five-key-takeaways-for-securing-your-family-legacy

- https://wealthmentor.co.nz/the-great-wealth-transfer/

- https://www.sowardslawfirm.com/blog/the-great-wealth-transfer-managing-your-inheritance-wisely/